Options to Avoid Foreclosure in Connecticut

You’re Not Alone , And You Still Have Choices

Get Clarity Before It’s Too Late

Falling behind on mortgage payments can feel crushing — but foreclosure isn’t the only outcome.

Many Connecticut homeowners in your shoes have found ways to stop foreclosure and move forward. Whether you want to keep your home or sell and reset, there are real options to explore.

👉 Learn the full process in How to Stop Foreclosure in Connecticut

👉 If time is tight, see How to Stop a Foreclosure Auction

👉 Wondering if selling makes sense? Check Pros and Cons of Selling Before Foreclosure

What Is Foreclosure and Why Acting Fast Matters

Foreclosure is the legal process where the bank takes your home if you miss too many payments.

Here’s what most people don’t realize:

Foreclosure takes time — and during that time, you can still act. Whether it’s working with your lender, selling the home, or exploring state programs, you still have power.

You might be wondering:

⏳ “Is it too late?”

💸 “What if I can’t afford a lawyer?”

🤷 “What are my actual options — and what’s a waste of time?”

Let’s break them down clearly.

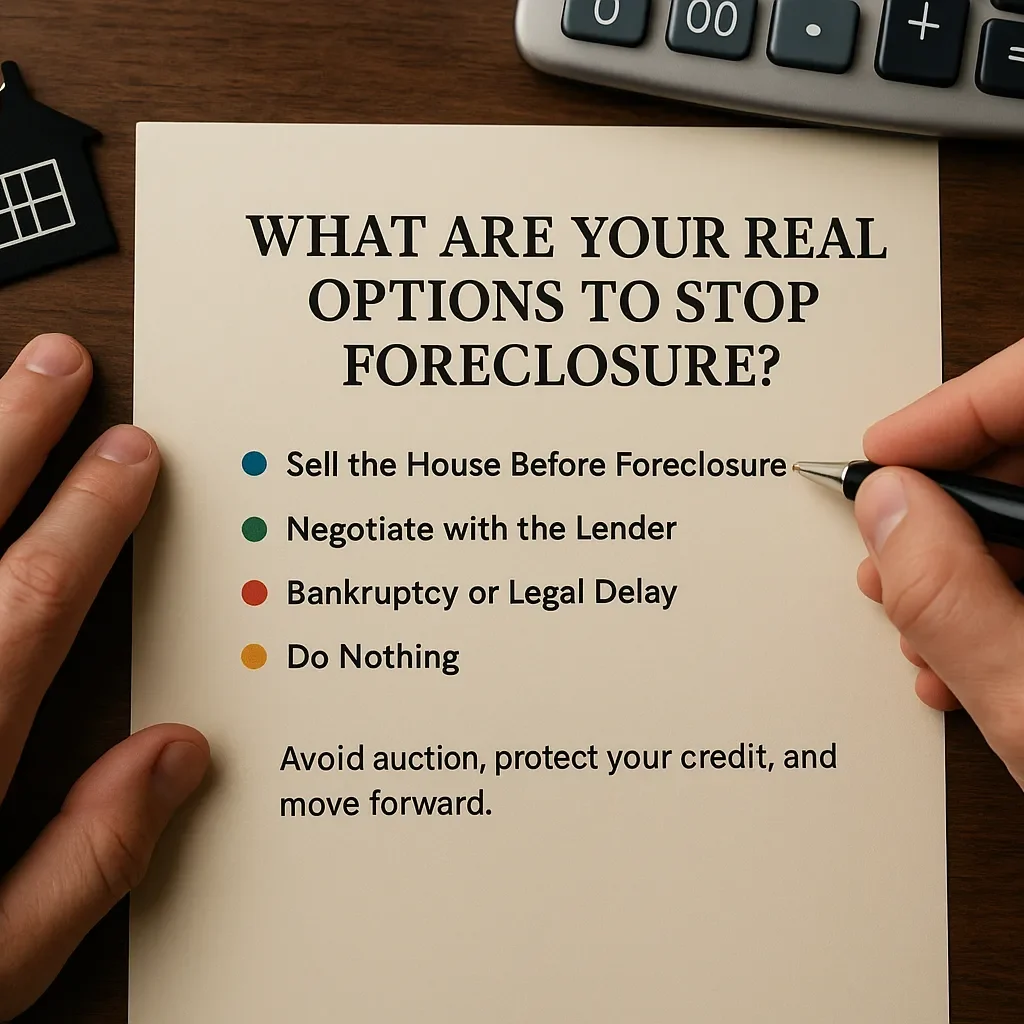

Your Options to Avoid Foreclosure

🔹 Loan Modification

Negotiate new terms with your lender (like a lower monthly payment) Foreclosure Prevention and Loan Modification Assistance

🔹 Forbearance

Ask to temporarily pause payments during hardship

🔹 Repayment Plan

Catch up on missed payments over time

🔹 Refinancing

Replace your loan with a better one (only works if you qualify)

🔹 Sell the House

Walk away before foreclosure hits your credit

📌 Learn more in Selling Your House to Avoid Foreclosure

📌 Already in the process? See Can I Sell My House During Foreclosure?

🔹 Deed in Lieu of Foreclosure

Give the property back to the bank — less damaging than foreclosure

🔹 Bankruptcy

Can stop foreclosure temporarily — but comes with serious consequences

🌐 Explore official resources:

Why Our Help Makes a Difference

Who We Are

We’re a local team based right here in Connecticut , not a big national chain.

You won’t get scripts or pressure from us, just honest guidance.

You’re not just a number to us. We know what you’re facing — and we treat it with care, respect, and zero pressure. Whether you sell your house to us or not, we’ll walk you through your options so you can make the best call for your situation. If we’re not your answer, we’ll help you find who is.

No judgment. No hard sell. Just real help when you need it most.

Our Simple 3-Step Process to Explore Solutions

📞 Step 1:

Talk to Us

We’ll listen. No pressure, no sales pitch just your story.

🔍 Step 2:

Explore Your Best Options Together

We’ll walk through your mortgage, property, and goals to help you make sense of it all.

🤝 Step 3:

Take the Next Step, on Your Terms

Whether you decide to sell, refinance, or ask your lender for help — we’ll walk with you every step of the way.

Need to sell fast? Visit How to Stop a Foreclosure Auction

FAQs Let’s Clear It Up

Can I stop foreclosure without selling my house?

→ Yes. Loan modifications, repayment plans, or state programs may help.

What is a deed in lieu?

→ You voluntarily give the house back — better than full foreclosure.

Can bankruptcy stop foreclosure?

→ It can, but it’s complex. Talk to a qualified attorney.

Are there free programs that help?

→ Yes. Visit Connecticut Legal Services or CHFA Assistance Fund

Is it really too late if I already got a foreclosure notice?

→ Often, no. The process takes time — and you may still be able to sell or negotiate

Let’s Make a Plan

You don’t have to rush. But you do have to know your options.

📞 [Call us for a free, no-pressure conversation]

💬 [Request a cash offer if selling seems right]

You’re in control. We’ll give you real answers — and real help — no matter what you decide.

👉 Explore the full picture in How to Stop Foreclosure in Connecticut